DeFi - The Next Internet for Assets?

DeFi is disrupting the exchange of real word assets across traditional financial networks by creating a global, decentralized, and interoperable settlement layer.

Introduction

Institutional DeFi (Decentralized Finance) is an emerging financial technology that is transforming the way organizations and institutions access and use financial services. It uses blockchain technology to build a decentralized, open, and borderless financial system that enables individuals and organizations to access financial services with greater ease, flexibility, and transparency. Institutional DeFi has the potential to revolutionize the world of finance by providing an alternative to traditional financial services that are often slow, expensive, and inefficient. By leveraging decentralized ledger technology, this new form of finance provides a secure, transparent, and cost-effective way for institutions and individuals to access financial services.

The Information Era

It was the 1960s, and the United States was in the midst of a Cold War with the Soviet Union. The two superpowers were in a race to develop new technology that would give them an edge in the conflict. President Dwight D. Eisenhower formed the Advanced Research Projects Agency, and among its projects was the development of a large-scale computer network.

The project was called the ARPANET. The ARPANET was designed to be a decentralized network. This meant that if one part of the network went down, the rest of the network would still be able to function. This was a critical feature, as it made the ARPANET faster and more resilient than any other computer network of the time.

In its early days, the APARNET was only used by academic institutions as a tool to link departments. However, as it expanded, different universities built out different standards - leading to fragmentation of networks. In fact, these networks were only operated properly when researchers relocated between colleges - as only they could communicate with their old department’s host.

This changed in the 1980s, as a new protocol called TCP/IP was developed for the ARPANET. TCP/IP was designed to build a general protocol or an open, dynamic network of networks. Finally, data packet exchange between different networks were possible. The internet expanded beyond institutions as users used the technology to reach a global customer base with products and services - offering better prices and quality. In 1989, scientist Tim Berners-Lee invented the world wide web at CERN - catalyzing the onboarding of 4.66 billion users onto the global internet and kicking off the information era.

As data coordination layers standardize and mature, their underlying networks interoperate faster and more reliably. This allows for better products and services to be provided across fragmented markets - creating a virtuous flywheel of increasing economies of scale and global network penetration.

Parallelism in Financial Networks

The APARNET’s early problems with data transfer paralleled historical issues faced by financial institutions in fixed income markets. For a long time, fixed income securities were ledgered across fragmented standards due to differences in the global rules and regulations governing their issuance. Lack of coordination among data standards led to frictions in data reconciliation and asset settlement. Thus, the financial assets held by banks were not easily traded. Bank originations were bottlenecked by long term, illiquid debt obligations on their balance sheets.

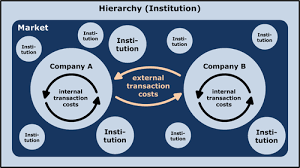

Before the 2008 financial crisis, broker-dealers had low costs of capital and balance-sheet funding. Dealers could warehouse risk in-house for extended periods of time - making significant markets in both cash bonds and associated derivatives. However, the crisis caused balance sheet and market liquidity reductions as many broker-dealers struggled with capital funding challenges. We can examine the consequences of the crisis to financial institutions through the published work “The Nature of the Firm,” by Ronald Coase — who would receive the Nobel Prize in Economics in 1991.

Coase deduced that transaction costs are why large companies tend to operate in insular, command-and control environments. He found that as long as the transaction costs of making an exchange of an intermediate good in the market was larger than the trade profit, it was rational for the firm to produce it in-house. Most of these Coasian transaction costs stemmed from the costs of acquiring and sharing information - due to the effort of finding buyers/suppliers, and negotiating and enforcing contracts.

Looking at financial institutions post crisis, we saw a reduction in traditional in-house risk warehousing by firms due to higher funding and capital costs. The bid-ask spread on corporate bonds increased from 0.15 percent in 2007 to 0.40 percent in 2016. Additionally, the number of firms making markets in corporate bonds declined from 200 in 2007 to 75 in 2016. Asset managers suffered from higher transaction costs, wider bid-ask spreads, and greater market risks and volatility.

True to Coase’s theorem, cash bond trading migrated to a hybrid principal/agency model. Here, buyers and sellers are located and matched by banks and broker-dealers, rather than facilitating trades through principal risk taking. The decline in in-house risk warehousing created increases in execution costs and times for larger trade sizes - materializing demand for trading technologies and liquidity providers.

Electronic penetration within fixed income markets lower transaction costs for traders by reducing information asymmetries - removing the frictions between firm-buyer matching. Lowering search and information costs for participants creates wider markets that foster inclusion and serve more participants.

Issues with Existing Electronic Markets

The momentum behind bond market electronification has resulted in the development of trading platforms, including: alternative trading protocols, central limit order books (CLOBs), and dark pools. However, at their current state, electronic trading systems also cause fragmentation within global bond markets.

For starters, electronic trading systems have varying internal designs to trade specific types of bonds/securities. This leads to different bonds being traded across fragmented systems - creating difficulties in matching prices and buyers. Exchange-style listings have also failed to solve this problem as the amount and variety of CUSIPs creates fragmentation, preventing an active trading market from being created on listed single bonds.

Distributed ledger technology has the potential to resolve inefficiencies in asset transfer through the availability of transactional and ownership information. The blockchain combines ledgers and networks in a transparent manner that allows any decentralized entity to view the same ledger - removing the need for post-trade reconciliation. Advances to data availability and electronic trading continue to evolve the transparency and execution efficiency around assets on a pre-trade and post-trade basis.

Financial firms are exploring adopting blockchain technology to represent real world assets as tokens. In addition to creating a layer of data coordination, blockchains also enable business logic to be executed in a deterministic manner. Tokenization enables interoperability, composability, and atomic settlement - decreasing settlement times and reducing settlement risks.

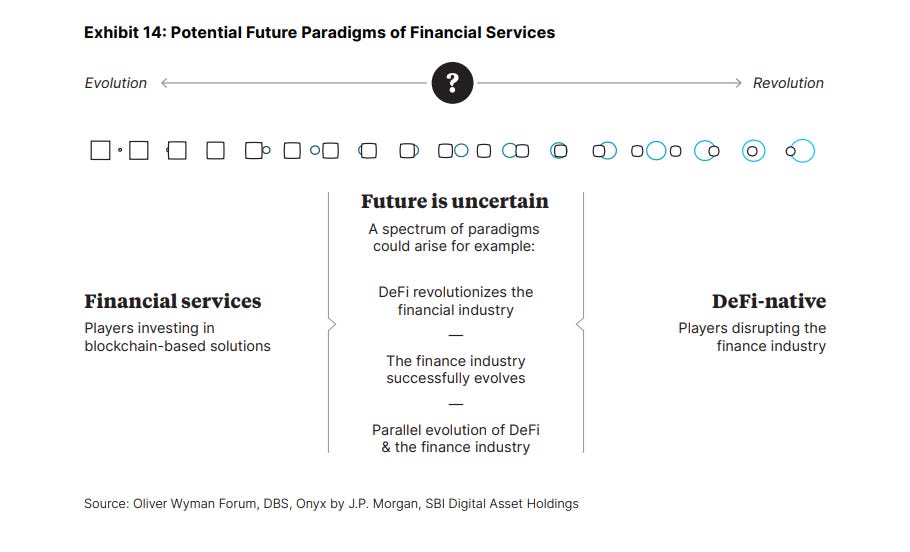

The DeFi Revolution

DeFi primitives will introduce novel paradigms, such as composability and atomicity, into the technology stack of financial institutions. Additionally, the maturity of the trade data ecosystem will allow for further advancements in trading infrastructure on public blockchains - enabling on-chain liquidity provisioning across automated market makers. This has the potential to generate massive reductions in transaction costs and execution times, as smart contract settlement vastly replaces intermediaries - including middle and back office operations. Financial services that leverage programmable money will have a major edge in the upcoming era of electronic asset transfer.

The centralized banking system is slow, inefficient, and opaque. The reason why DeFi is so dangerous to the central banking cartel is because it threatens to upend the entire system. Monetary policy is designed to enrich those who are “credit-worthy” - creating a permanent debt spiral that can only be serviced by ever-increasing levels of debt and inflation. In contrast, transparent, technology enabled markets allow for democratization of monetary supply and meritocratic allocation of debt.

Rather than endless Ponzi’s - real world assets will be unlocked on-chain and their productive value will be re-distributed to billions across decentralized networks. Like how businesses were forced to adapt to the internet, assets will be forced to adapt to electronic servicing to compete on capital markets. An era will be ushered of IOT device equipped birth assets to enable live data streams, continuous underwriting, and real-time risk monitoring on tokenized debt. DeFi will catalyze an infrastructural boom, evolving at the pace of Moore’s law - as technological innovation will be incentivized through lower costs of capital offered through decentralized financial layers.